Small GEOs – the latest solution in the long list of capacity options that operators are looking to implement. With rising competition in most countries, and decreasing break-even pricing via ever more efficient satellites and reduced launch costs, many operators see large GEO sats as quite risky for regional appetite.

To set the small GEO wheel moving, Astranis recently signed PDI as a customer and Ovzon placed an order with Maxar. NSR also learned of several other operators considering small GEOs as a true option for specific capacity deployment and (perhaps more importantly) orbital slot protection.

Thus, enter the small GEO, averaging 300-1,000 kg., a price tag of $65 to $100 million and output of 10 to 30 Gbps — NSR set out to answer the following small GEO questions in detail:

- Does it solve the HTS niche strategy problem? Selectively Yes

- Does it solve competitiveness with respect to over-supply? To an extent, depending on player’s vertical leadership in the region

- Does it give flexibility to prioritize regions? Certainly

- Does it beat the large GEO birds on cost per Gbps? No, 2-3x as expensive

Before analyzing the above questions, below is a recap on major industry trends, as forecasted by NSR:

- 4% CAGR for GEO-HTS supply growth till 2028

- 50%-70% decrease in break-even pricing for medium-sized HTS satellites between 25 and 200 Gbps capacity

- Focus on masses: most dollars to be generated via consumer broadband retail business

- Focus on max dollars per megabyte: IFC sector to witness highest consumption increase per consumer (akin to cruise between 2015-2019 period)

- SPs demanding flexibility over bandwidth aggregation to optimize leased vs. usable capacity

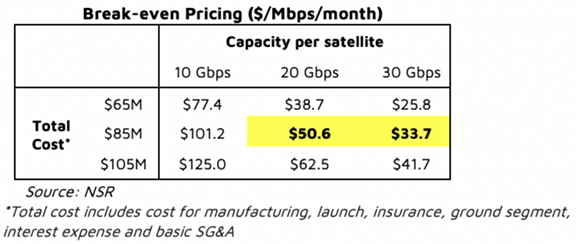

Figure 1.

How will small GEOs add value in this ultra-competitive marketplace? The break-even pricing metric gives a realistic estimate towards the total cost and capacity per satellite as seen in Figure 1:

Compared to VHTS systems with average break-even pricing at $12/Mbps/Mo (100 percent fill-rate theoretical assumption), this is high, and a break-even price between $33 to 50 per Mbps per month can only be competitive for regions with delayed VHTS capacity or with focus on high revenue per Mbps verticals.

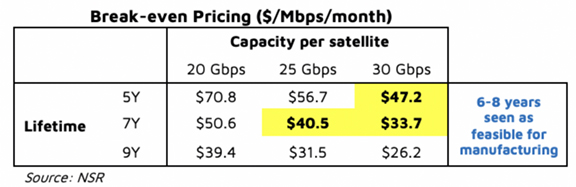

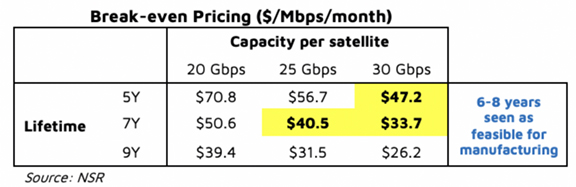

Breaking out by lifetime, a more compact range towards feasible break-even pricing, and capacity per satellite can be brought out as described in the Figure 2.

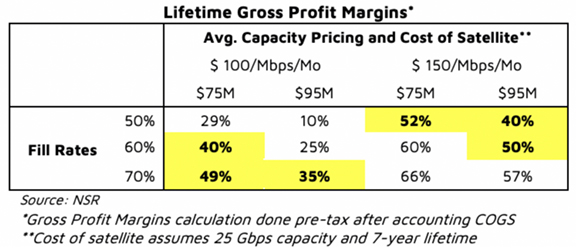

With these parameters, NSR calculated the Lifetime Gross Profit Margin per satellite for 25 Gbps/8 years lifetime and 30 Gbps/6 years lifetime, against various average pricing scenarios. The exhibit below showcases preliminary expectations towards profitability for pricing levels expected during the 2021-2028 timeframe.

Notice the minimal profitability at $75/Mbps/Mo price level when Viasat and Hughes are expected to sell capacity below $30/Mbps/Mo with Viasat-3 and Jupiter-3 VHTS. This strongly indicates a preference towards verticals of high value; aka IFC, Maritime and Enterprise (Commercial/Govt).

The high value verticals indicate a reasonable ROI, as indicated in the chart below, for $100 to $150/Mbps/Mo price points. Small GEOs are expected to tread a thin line between creating value for customers (reduced CAPEX and time-to-market risk) and maintaining a high enough fill rate at low price points to register >65 percent EBITDA per satellite and lifetime gross profit margin between 40 to 50 percent.

Overall Benefits

- Reduce CAPEX risk

- Sell pre-launch, reduce sales OPEX, preferably with an anchor client and added benefit of low time-to-market

- Could be used as a gap filler satellite by operators or SPs until VHTS economics kick in, and then diverted to a region with similar need

- Opportunity for use towards video or Gov/Mil – fulfil need for smaller/dedicated satellites.

NSR’s small GEO cost-benefit analysis is skewed toward selective cases. A satellite, with $85 million total cost, a 7 year lifetime, 25 Gbps of capacity, at a mean 70 percent fill rate, could return ~40 to 60 percent lifetime gross profit margin (non-discounted) for a median $125/Mbps/Mo capacity price point.

With shortened lifetime, regional flexibility and low capacity — risk is reduced via small GEOs. Though, high system costs per Gbps and low margin trade-off between high fill rates and high price offerings could prove risky and can curtail enthusiasm towards small GEO choice. Maintaining a 60-70% lifetime average fill rate has been historically tough, thus any slow ramp-up may adversely affect profitability.

Ambitious service providers might find this option attractive, as network efficiency/usage flexibility could be best provided via a small GEO sat deployment. Reliance on higher profitability verticals (IFC/Maritime/Enterprise) to generate industry benchmark IRR will warrant regional leadership from players, otherwise gross profit margins are bound to suffer.

Does a profitable market exist? Definitely. With the same IRR as in the industry heyday? Less probable. Are they a reasonable alternative to VHTS for non-consumer applications? Absolutely, especially for niche markets. Would it enable individual asset specific buyouts? Looks custom built for it.

For a rundown on NSR’s Satellite and Space Infrastructure report and analysis offerings, select this direct infolink…

Article by Gagan Agrawal, NSR Senior Analyst, Mumbai, India