Approximately 2,000 artificial satellites orbiting Earth relay analog and digital signals carrying voice, video, and data to and from one or many locations worldwide.

Satellite communication has two main components: the ground segment, which consists of fixed or mobile transmission, reception, and ancillary equipment, and the space segment, which primarily is the satellite itself.

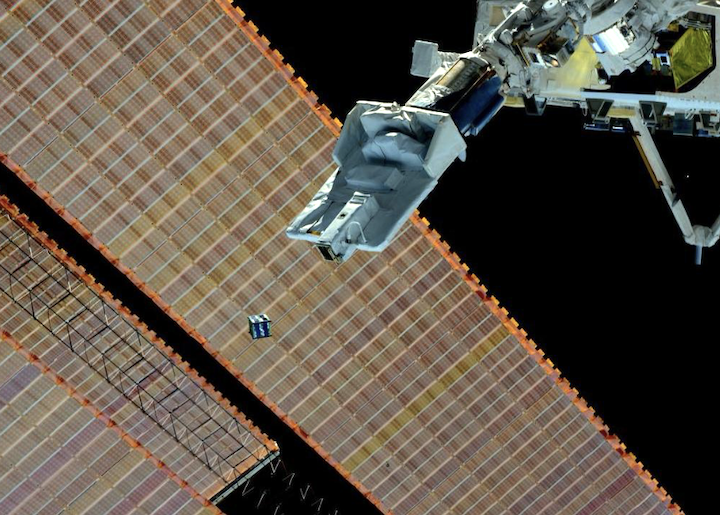

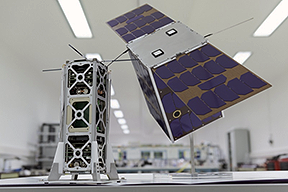

Both the commercial and military satellite communication industry is evolving, as evidenced by numerous trends that one can expect to see on the horizon over the coming 18 months and beyond. The increase in smallsats, the use of LEO, launches on reusable rocket launch vehicles and new use cases for 5G and the Internet of Things (IoT) are some of the most important developments to watch.

Market Forecast’s latest report “Global Commercial and Military Satellite Communications Market and Technology Forecast to 2028” examines, analyzes, and predicts the evolution of satellite systems, technologies, markets, and outlays (expenditures) over the next 8 years – 2020 -2028 in the Global Commercial & Military Satellite Communication industry. It also examines commercial and military satellite markets geographically, focusing on the top 95% of global markets, in the United States, Europe, and Asia. The commercial and military satellite market is expected to grow at a CAGR of 76.6% during this period with a cumulative $195.11 billion over the period 2020-2028.

The report shows how satellite communication is used today to add real value. To provide the most thorough and realistic forecast, this report provides a twin-scenario analysis, including “steady state,” emergence of new satellite communication technology.

In this report, light is shed on major technologies and services in this domain. These include…

- Laser SATCOM Communications

- Terrestrial Based Fiber Optics

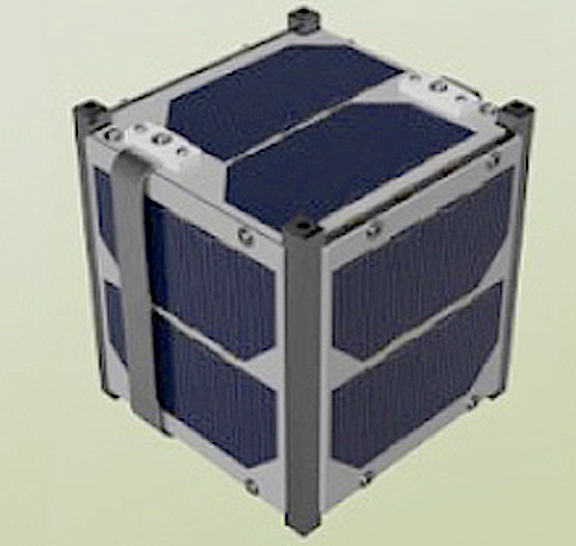

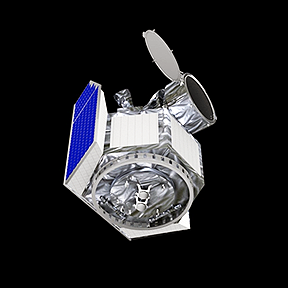

- Smallsats

- C-band

- Ka-band

- Ku-band

In particular, this report provides an in-depth analysis of the following…

Overview

Snapshot of the various satellite communication tech in the aerospace market during 2020-2028, including highlights of the demand drivers, trends and challenges. It also provides a snapshot of the spending with respect to regions as well as segments. It also sheds light on the emergence on new technologies

Market Dynamics

Insights into the technological developments in this market and a detailed analysis of the changing preferences of governments around the world. It also analyzes changing industry structure trends and the challenges faced by the industry participants.

Segment Analysis

Insights into the various Systems market from a segmental perspective and a detailed analysis of factors influencing the market for each segment.

Regional Review

Insights into modernization patterns and budgetary allocation for top countries within a region.

Regional Analysis

Insights into the Systems market from a regional perspective and a detailed analysis of factors influencing the market for each region.

Trend Analysis

Key satellite communication markets: Analysis of the key markets in each region, providing an analysis of the various Systems segments expected to be in demand in each region. Key Program Analysis: Details of the top programs in each segment expected to be executed during the forecast period. Competitive landscape Analysis: Analysis of competitive landscape of this industry. It provides an overview of key companies, together with insights such as key alliances, strategic initiatives and a brief financial analysis.